what is suta tax rate for california

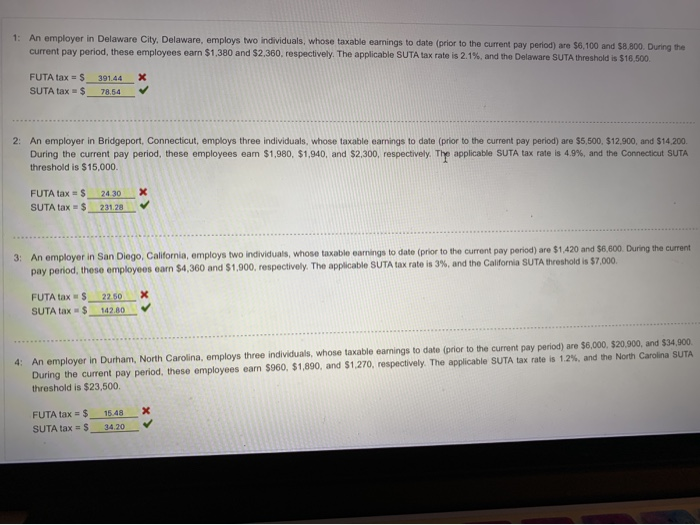

The SUI taxable wage base for 2021 remains at 7000 per employee. The Federal Unemployment Tax Act FUTA is a payroll or unemployment tax that employers pay to the federal government to fund unemployment insurance programs and unemployment benefits for individuals with no jobs.

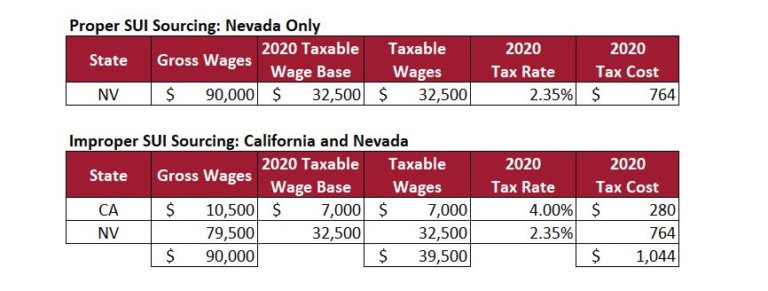

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Transmittal of Wage and Tax Statements Form W-3 1.

. The California Employment Development Department has confirmed that unemployment tax rates are unchanged for 2022 on its website. Employers in these states will be subject to a 030 increase in their FUTA tax rate for all of 2022 increasing the rate from 060 to 090. California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate Form W-4 or DE 4 on file with their employer.

SUTA State Unemployment Tax Act dumping one of the biggest issues facing the Unemployment Insurance UI program is a tax evasion scheme where shell companies are formed and creatively manipulated to obtain low UI tax rates. FUTA tax rates can increase further in increments of 030 per year should loans remain outstanding in subsequent years. For example the SUTA tax rates in.

According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. Alaska New Jersey and Pennsylvania collect. You will pay 1050 in SUI.

The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. SUTA was established to provide unemployment benefits. Is There A Way To Find My Unemployment Id Number I How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor Futa Tax Overview How It Works How To.

The SUI taxable wage base for 2020 remains at 7000 per employee. Generally states have a range of unemployment tax rates for established employers. In 2018 the trust fund regained a positive balance after nine years of insolvency.

The SDI withholding rate is the same for all employees and is calculated annually. 5 of 7000 350. FUTA tax rate is 6 of the first 7000 paid to an employee annually.

There is no maximum tax. Since your business has. 52 rows California 340 15 62 7000 Colorado 17 to 774 071 964.

Only then the State will send details about the unemployment tax rate to the employer each year. Most COVID-19 related staff reductions occurred in the second quarter of 2020. What is FUTA Tax.

Through the State Unemployment Tax Act SUTA states levy a payroll tax on employers to fund the majority of their unemployment benefit programs. Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. There is no taxable wage limit.

FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. The states SUTA wage base is 7000 per employee. For example the wage base limit in California is 7000.

52 rows Most states send employers a new SUTA tax rate each year. According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows.

The new-employer tax rate will also remain stable at 340. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the account with the. The tax rate may vary each year depending on the claim towards unemployment funds of.

2022 the unemployment-taxable wage base is to be 7000 the department said on its website. Employers with a positive reserve. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees.

350 x 3 1050. The taxable wage limit is 145600 for each employee per calendar year. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base.

What is California tax rate for payroll. The 2020 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. What is California tax rate for payroll.

The new employer SUI tax rate remains at 34 for 2020. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers. Your state will assign you a rate within this range.

Review the PIT withholding schedule. Effective January 1 2022 unemployment tax rates will hold steady as compared to 2021 ranging from 150 to 620. 2020 SUI tax rates and taxable wage base.

1 2021 the unemployment-taxable wage base is to be 7000 the spokesman told Bloomberg Tax in an email. Keep in mind that earnings exceeding 7000. Californias unemployment tax rates and unemployment-taxable wage base are to be unchanged for 2021 a spokesman for the state Employment Development Department said Oct.

Californias unemployment tax rates and wage base are not to change in 2022 while the state disability insurance wage base is to rise the state Employment Development Department said Oct. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The withholding rate is based on the employees Form W-4 or DE 4.

For example if you own a non-construction business in California in 2021 the SUTA new employer tax rate is 34 and the taxable wage base per worker is 7000. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. 20 rows California.

Employers in California are subject to a SUTA rate between 15 and 62. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. For 2022 as in 2021 unemployment tax rates for.

Here is how to do your calculation. The new employer SUI tax rate remains at 34 for 2021.

The True Cost Of Hiring An Employee In California Hiring True Cost California

What Is Sui State Unemployment Insurance Tax Ask Gusto

How To Update Suta And Ett Rates For California Edd In Qbo Youtube

Futa Tax Overview How It Works How To Calculate

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

Suta Tax Your Questions Answered Bench Accounting

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Federal State Payroll Tax Rates For Employers

Is A Change In State Unemployment Reporting Necessary Due To Covid 19 Workforce Wise Blog

What Is Sui State Unemployment Insurance Tax Ask Gusto

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

Calculator Percentage Equal To Or Less Than Chegg Com

A Complete Guide To California Payroll Taxes Rjs Law

Solved I Fugured Out Suta But Need Help Finding The Futa Tax Chegg Com

Payroll Taxes Cost Of Hiring An Hourly Worker In California In 2020

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer